Canada is well known around the world for its strong and highly regulated financial services industry. This reputation however comes with numerous challenges and costs, as increasing regulatory oversight and compliance requirements have become more complex and multi-layered. As the industry struggles to keep up with the rapidity of these changes, the costs and complexity of new technology and regulatory requirements pose increasing challenges.

The Ticoon Platform has been designed to address many problems and challenges facing the compliance and security professionals working in the Canadian financial services industry.

Download Navigating the Compliance Jungle with Ticoon as a PDF document.

Here are 17 examples of how the Ticoon Platform addresses these issues:

1. Data Consolidation

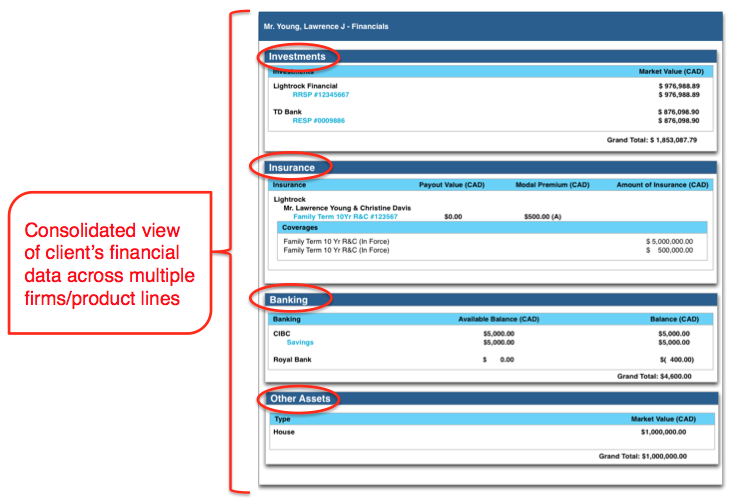

Problem: The vertical structure of the financial industry means that client and household financial data is often held in multiple accounts spread across multiple technology systems that do not interact with each other.

Solution: Ticoon consolidates client and advisor data from multiple in-house and 3rd party systems. The Ticoon Platform can be configured to support career advisor networks, offering a single view of the client or household across multiple product lines that can include all investment, life insurance, living benefits and banking information.

Similarly, the Ticoon Platform supports independent advisors and firms and can be configured to provide a single view of a client or household across multiple dealers, MGAs and 3rd party product partners. In all cases, consolidated data views support regulatory rules around segmentation and branding and are presented with required regulatory disclaimers.

The Ticoon Platform consolidates data from across vertical industry silos.

2. Authorized Data Access and Views

Problem: It is difficult to adhere to privacy laws and confidentiality “best practices”, because data consolidation processes are performed manually between disconnected systems, most of which only support an “all-or-none” data access model.

Solution: On the Ticoon Platform, data is organized to support the sponsoring firms’ access hierarchy. Access to data is explicitly granted by role type or to specific users. For example, a firm may be organized hierarchically, requiring data to be viewed at any of the national, regional, branch, advisor, household, contact, and account levels. Data Access may be granted to a user at any of these levels, based on their permissions, licenses and/or client consent, thereby ensuring that a user will not have access to any data they are not authorized to view.

3. Data Segmentation and Presentation

Problem: Consolidated client financial data may come from multiple sources and may be either official or unofficial to the advisor’s book of record. This data needs to be segmented by source and classification to meet compliance and regulatory requirements.

Solution: On the Ticoon Platform, product data is clearly segmented and properly presented to meet regulatory and compliance requirements, both on screen and within client reports. Data sources are identified and appropriately branded to provide users with a clear understanding with respect to:

- Products managed or administered directly by the advisor

- Products managed or administered by a third-party and reported to the advisor

- Products that have been manually entered on the system

- Products for which the Advisor is not licensed to provide advice

4. Data Storage and Security

Problem: Financial and personal data stored on computer servers outside of Canada are subject to the laws of the country in which the servers reside, potentially exposing private client data to other jurisdictional legislation that may contravene Canadian laws.

Solution: All data on the Ticoon Platform is stored in an encrypted state on computer servers residing solely in Canada. Ticoon servers are hosted in an enterprise data centre. Data is backed up daily and replicated on other offsite data centres. The Ticoon Platform functions as a disaster recovery solution for our customers’ most sensitive private client data.

Data in the Ticoon system resides on servers in Canada and is never stored in data centres outside the country.

5. Independent Consumer Portal

Problem: Dealer or institution-owned consumer portals create a responsibility for dealers and product manufacturers.

Solution: TicoonTouch is a fully independent consumer portal.

- Fully independent of your business. TicoonTouch is not branded for the Dealer, MGA, or any other financial institution.

- Not an official book of record. TicoonTouch provides users with a consolidated view of the household for long term planning purposes and information only. TicoonTouch does not provide any advice, or direction and all screens and reports contain very explicit and legally vetted disclaimers.

- Compliant with data firm Terms and Conditions. Ticoon has agreements and relationships with each data provider and all data is transported and stored using a secure methodology. Ticoon does not screen-scrape or require a user to enter their login credentials for other sites.

- Advisor-Consumer Connections. Advisors ‘invite’ their clients and prospects to connect with them using Ticoon, similar to Facebook orLinkedIn. In theory, Consumer’s can connect with multiple advisors.

- Communication & Activity Audits. All Advisor-Consumer communications are stored and available to support an audit.

TicoonTouch (pictured above) is an independent consumer portal.

6. Client Access to Consolidated Data Views

Problem: Clients whose financial holdings and products are managed by multiple advisors or firms, or even across different lines of business within the same firm, cannot access their data in one location in a single, consolidated view.

Solution: The Ticoon Platform consolidates data from multiple advisors and firms, and offers a single portal through which clients can view all of their holdings, financial products and insurance data.

7. Client Consent

Problem: Consent to share client data must be managed on multiple levels and back-office systems.

Solution: The Ticoon Platform provides flexibility for appropriate levels of client consent to be determined on a client-by-client basis and supports multiple options for administering this consent process, including account agreements, user agreements or other compliant consent-granting processes.

8. Know Your Client (KYC)

Problem: Multiple regulations from different licensing bodies may conflict around the level of which KYC information is to be collected. KYC requirements can be contact, account and/or product based and within different market verticals and, as such, do a poor job of taking into consideration a comprehensive view of the client’s (and their household) financial situation and holdings.

Solution: The Ticoon Platform provides a 360-degree view of the client that may include the following financial products:

- Investments (securities, funds, managed portfolios, ETF, segregated funds, other)

- Life Insurance policies

- Living Benefits policies

- Annuities

- Banking products

- Exempt Market products

- Other assets including real estate, art, personal investments

- Other liabilities including personal loans

- Goals and needs information

Client contacts can be grouped into households, which can include partners, spouses, dependents and any other individual considered part of the household (e.g., elderly parents) in order to get the most comprehensive view of the client for the purpose of assessing product suitability.

9. Know Your Advisor (KYA)

Problem: Many dealers lack a comprehensive system for managing key information about their advisors and their overall book of business in order to protect the dealership from potential compliance infractions.

Solution: The Ticoon Platform creates a single view of the advisor that includes:

- All of their licenses and industry credentials

- List of all team members and details

- List of all referral partners and business associates

- Total book of business including all investment, insurance, banking and outside business activity

By organizing this information into one system, Ticoon provides firms and distributors with actionable data for ensuring regulatory compliance and driving business development objectives.

10. Advisor Outside Business Activity (OBA) and Referral Business

Problem: Outside Business Activity (OBA) or referral business not administered by a dealer is often poorly tracked in dealer systems, even though this information is relevant for planning and compliance purposes to advisors and their clients.

Solution: The Ticoon Platform supports the manual entry and/or electronic data feeds when available of most outside business activity in order to facilitate tracking by the advisor and client. Dealer access to view outside business activity and referral business is determined on a dealer-by-dealer basis (depends on the dealer-advisor relationship and business model) and such data is segmented and organized on screen and within reports and clearly marked that it is NOT dealer business, in order to meet varying compliance requirements on outside business activity and referral business.

11. Canadian Anti-Spam Legislation (CASL)

Problem: Many CASL-compliant email list management services are external to a firm’s main customer database and the dealer has no view into the advisor’s email activity.

Solution: The Ticoon Platform offers a fully CASL-compliant email marketing solution for firms and advisors. Marketing emails that are sent from within the Ticoon system require that a user has not opted out of receiving email marketing, and are stored on a by-email-address basis. Each email sent from within Ticoon contains a fully CASL-compliant footer allowing the recipient to unsubscribe and opt-out of receiving future marketing messages. All CASL-compliant email communications are integrated with the client record on the Ticoon system and available for audit purposes.

12. Secure Messaging

Problem: It is still common practice in many firms for private client data to be transmitted over unsecured public email or other communication programs making it vulnerable to security breach.

Solution: Messages between advisors and clients are transmitted within the Ticoon Platform and never leave Ticoon’s servers. Email notifications can be provided to the recipient when a secure message has been sent, but the secure message and its contents never pass over the public Internet. All secure messages between Ticoon system users (i.e., advisors and clients) are tracked and available for audit purposes.

13. Secure and Compliant Document Delivery (E-Delivery)

Problem: Financial services firms are required to comply with federal electronic document legislation.

Solution: The Ticoon Platform meets all federal government electronic document delivery requirements, as well as IIROC, MFDA and OSFI supplementary requirements. Ticoon’s e-delivery solution is currently in production with one of Canada’s largest financial institutions with tens of thousands of users.

14. Document Publishing & Verification

Problem: Documents containing private information are often transmitted via email and/or public file sharing services, making them vulnerable to security breaches.

Solution: Documents attached to the client’s contact record on the Ticoon Platform can be published to the client portal avoiding any risk associated with transmission over public email. Documents published to the client portal never leave Ticoon’s secure servers. Documents attached and published to the client contact record by the dealer can be locked down to prevent deletion or editing by the advisor, making this an excellent solution for sharing pre-filled forms, reports, financial plans, and other sensitive documents with your clients.

15. Reports vs. Statements

Problem: Manually produced reports can be misunderstood by clients to be statements if they do not contain appropriate disclaimers.

Solution: Ticoon does not produce any official client statements, however the Ticoon Platform can be used to deliver these official client statements via our e-delivery program. E-delivered statements are always provided in a secure, locked-down format. The Ticoon platform can be used to produces unofficial reports that contain appropriate disclaimers required for regulatory compliance purposes. Unofficial reports can be attached to client records and published directly to the client portal avoiding the security risks of public email. All documents generated in Ticoon are prepared as locked .pdfs, and are stored in an encrypted format.

16. User Activity Audit

Problem: Communications and interactions with clients are usually tracked through multiple external systems that are separate from other client records and documentation.

Solution: All user activity is tracked and recorded in the Ticoon database and available for audit purposes. User activity includes: page views, communications, notes, appointments, tasks and documents.

17. Client/Account Notes

Problem: Advisors’ notes and records about client communications are stored in multiple systems and formats and are easily lost over time.

Solution: Users can attach client notes at any of the household, contact or account levels. All notes are accessible for audit purposes. Notes may be added to the system directly or uploaded as attachments to emails, documents and other places. Multiple parties who have permission to access the client record are able to record and/or view notes. Notes are stored indefinitely on the Ticoon Platform.